Describe the Various Types of Marketable Securities

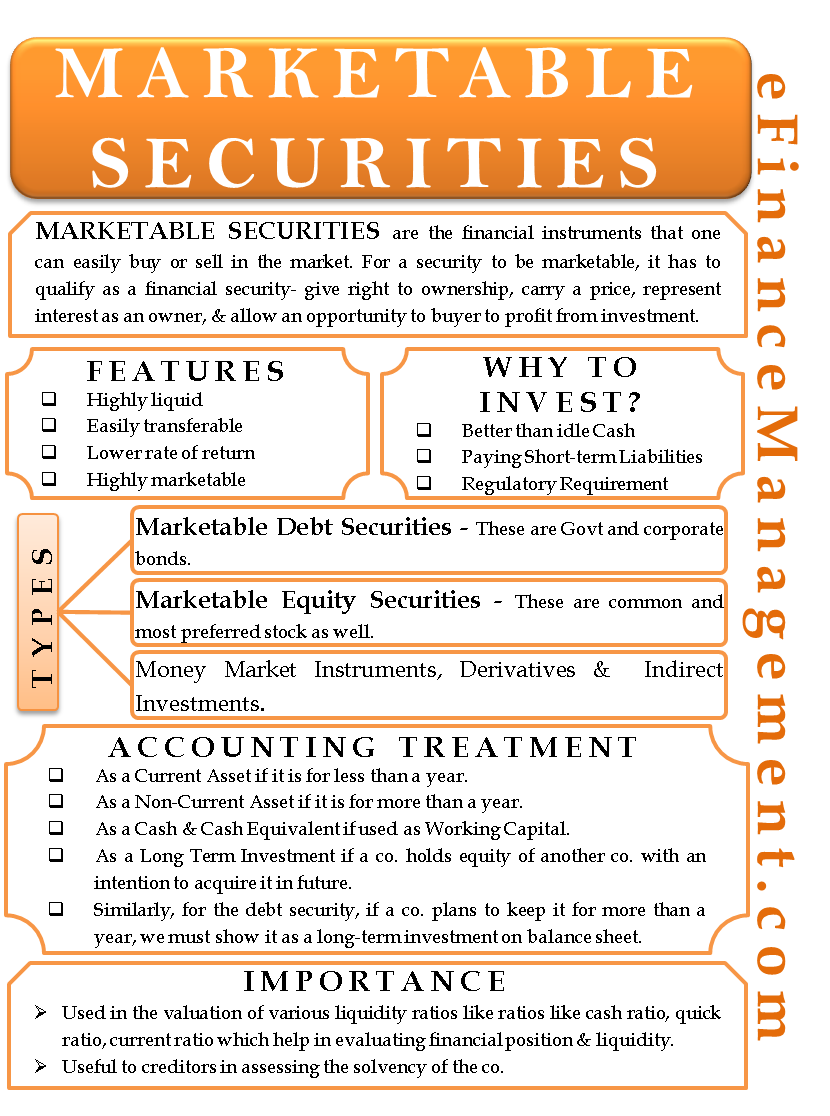

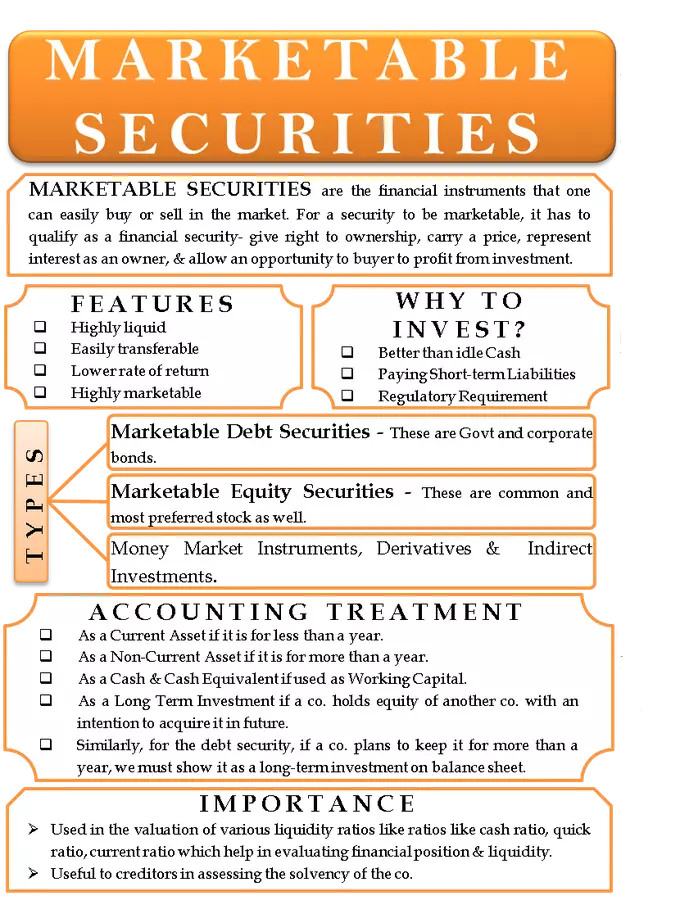

These are treasury bills are often purchases at discounted prices and mature in one year or less where the full face value of the mount is received. Marketable securities broadly have two groups Marketable debt securities and Marketable equity securities.

Large-company common stocksSmall-company common stocks small capsCorporate bonds Long-termGovernment bonds Long-termImmediate-term.

. What are the different types of securities. Treasury bills domestic and foreign banks eg certificates of deposit and business corporations eg commercial paper. Certificate of deposit issued by commercial banks and brokerage companies available in minimum amounts of 100000 which may be traded prior to maturity.

-Commercial Certificates of Deposit CDs. Zero-coupons securities STRIPS which are treasury securities separate the principal from the interest and do not make periodic interest payments. By the way of trading.

One can trade these on the public exchange and their market price is also readily available. One can trade these on the public exchange and their market price is also readily available. They are issued by the US.

They involve borrowed money and. Venture capital leveraged buyouts and private investments in public equity PIPE. SOME DIFFERENT TYPES OF MONEY MARKET SECURITIES Money market securities are generally highly marketable and short-term.

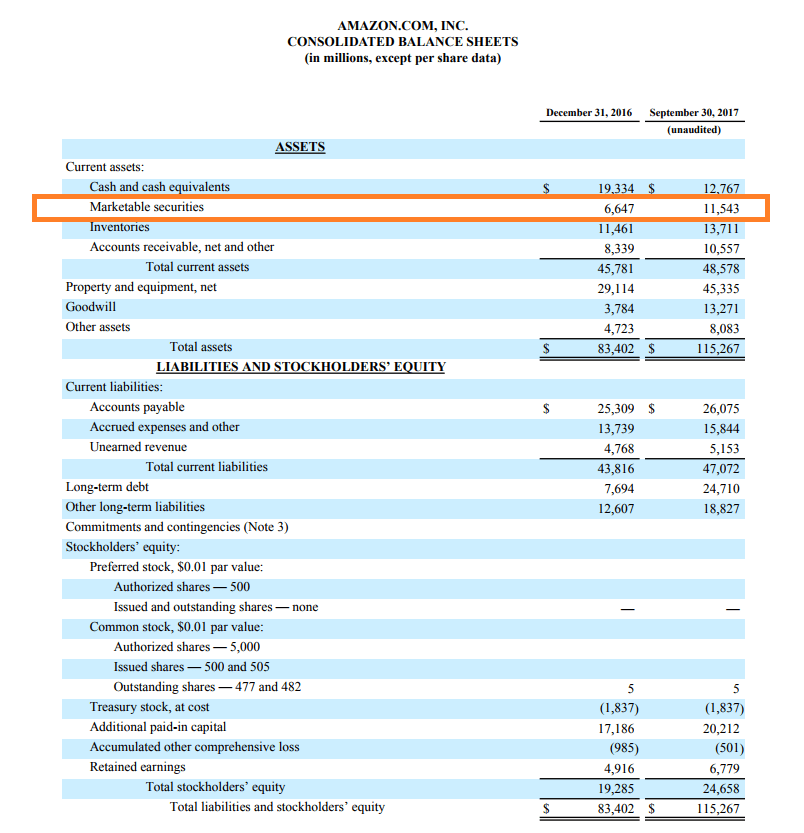

It based its decision on the fact that Section 2 h of the Securities Contracts Regulation Act 1956 defines securities to include shares scrips stocks bonds debenture stocks or other marketable securities of like nature in or of any incorporated company or other body corporate and that the term hybrids has been defined as any security having the. Stock represents a claim on the companys assets and earnings. Marketable securities are a component of current assets on a firms balance.

These classifications are dependent on certain criteria but also on the history of transactions any given investor or firm has employed in their past accounting practices. A stock is a share an individual or a company purchases in the ownership of a company. In short Marketable Securities is an investment option for the organization to earn returns on existing cash while maintaining cash flow Cash While Maintaining Cash Flow Cash Flow is the amount of cash or cash equivalent generated consumed by a Company over a given period.

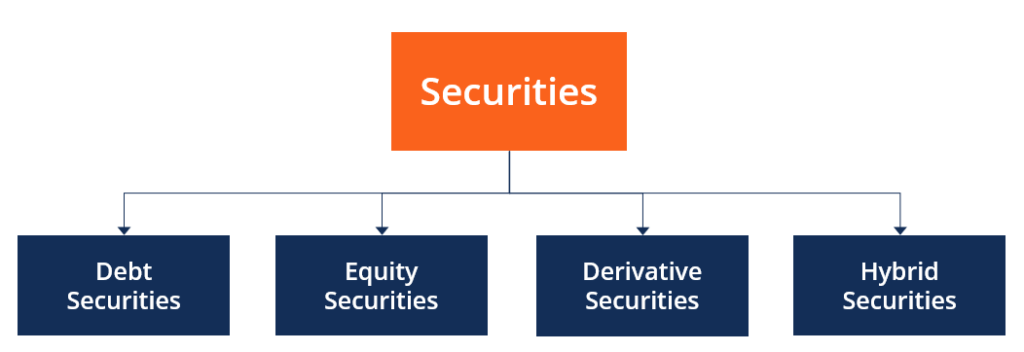

They usually have low risk of default. Types of Marketable Securities. Cash market a market of immediate execution of transactions up to two working days Derivatives Market a market of derivative securities with delayed execution of transactions.

Banks usually enjoy general lien. Treasury inflation-protected securities TIPS are those securities. A written promise one.

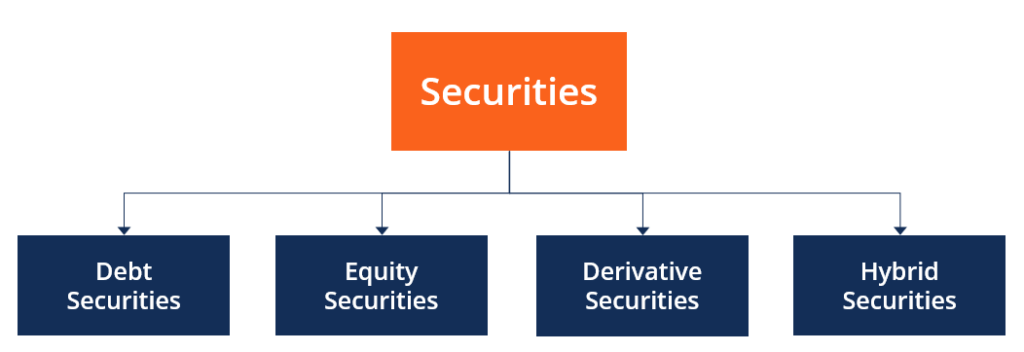

Lien can be of two types a Particular lien is a right to retain goods until a claim pertaining to these goods is fully paid and b general lien can be applied till all dues of the claimant are paid. Types of Securities 1. Since there is a secondary market or a middleman available buyers and sellers are not required to meet physically.

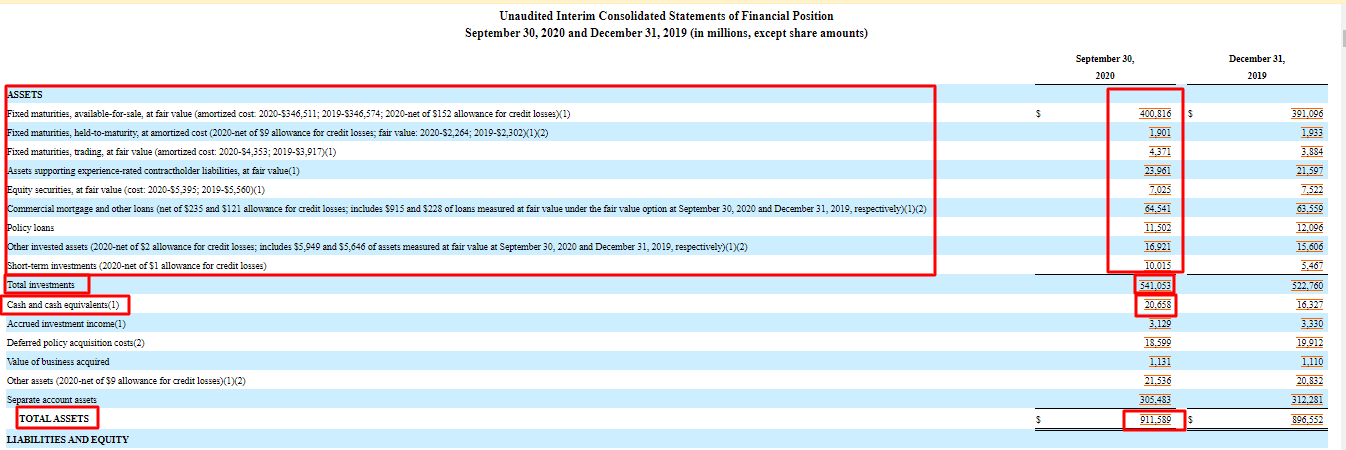

Corporate securities market commercial enterprises act as issuers. There are three types of private equity investments. In the balance sheet all marketable debt securities are shown as current at the cost until a.

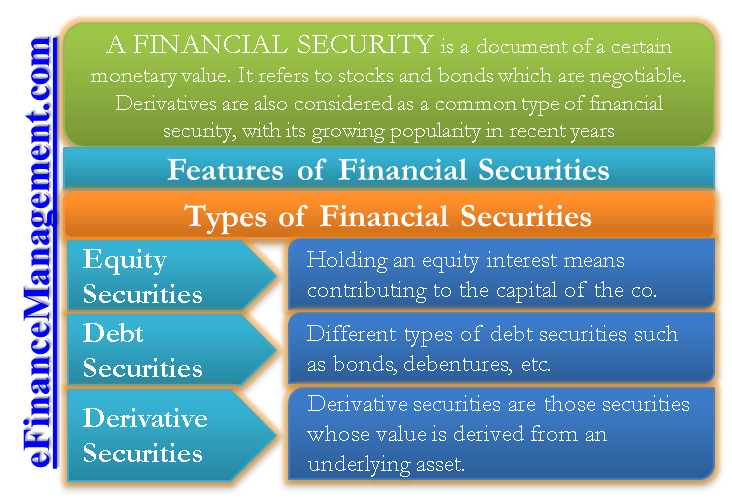

Marketable debt securities are government bonds and corporate bonds. Short-term debt obligations the US. An equity security is described as a security representing an ownership interest such as common preferred or other capital stock.

Some examples of marketable securities that you might be familiar with include Treasury bills money market instruments and commercial paper. Marketable securities broadly have two groups marketable debt securities and marketable equity securities. By the types of transactions.

There are three different classifications of marketable securities. Private equity securities are issued primarily to institutional investors in private placements and do not trade in secondary equity markets. Mortgage is the additional security of immoveable property to obtain short - term loan.

Common examples of marketable securities include stocks bonds certificates of deposit CD or commodities contracts. In the balance sheet all marketable debt securities are shown as current at the cost until a. Equity shares bonds mutual funds and others are examples of marketable securities.

There is no direct relationship between the issuer and the investor in case of non-marketable securities. Government sells to raise money. It also includes rights to acquire or dispose of an ownership interest at an agreed-upon or determinable price such as warrants rights and call options or.

It proves to be a prerequisite for analyzing the businesss strength profitability scope for. Equity securities Equity almost always refers to stocks and a share of ownership in a company which is possessed by. Marketable debt securities are government bonds and corporate bonds.

There are 3 types of Marketable Securities. Debt securities Debt securities differ from equity securities in an important way.

Marketable Securities Liquid Investments Definition Example

Financial Securities Definition Features Types Efm

Marketable Securities In Depth Guide What They Are Valuation And Impact

Marketable Vs Non Marketable Securities The Best Guide 2022

Classification Of Marketable And Non Marketable Securities Wealth How

Classification Of Marketable And Non Marketable Securities Wealth How

Cash And Marketable Securities Management Ppt Download

Marketable Securities Meaning Types Importance And More

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)

Common Examples Of Marketable Securities

Types Of Marketable Securities Qs Study

Marketable Securities Definition Example Types Debt Vs Equity Guide

Types Of Security Overview Examples How They Work

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)

Common Examples Of Marketable Securities

Marketable Securities Liquid Investments Definition Example

Marketable Securities Stock Photo Alamy

Management Of Marketable Securities Indiafreenotes

Trading Securities Accounting Double Entry Bookkeeping

Marketable Vs Non Marketable Securities The Best Guide 2022

What Are Marketable Securities Definition And Examples Thestreet

Comments

Post a Comment